2012-China-ASEAN Forum Report5

experienced better standard of living after road rehabitation. However, majority of local residents did not have awareness of potential benefits in their career or business from the development of the corridors. The main reasons for the reluctance to switch jobs or start new business come from a lack of capital or skills.

Cheewatrakoolpong (2009) considers stakeholder consultation and coordination problems in the implementation of Economic Corridor and CBTA initiatives in Thailand. The study finds that policy formulation of the two mentioned initiatives lacks of consultation with border communities and the poor even though they encounter significant impact from the initiatives due to changes in ways of life, job characteristics, social structure, the environment and economic structure. Moreover, many of them experience negative effect from transport and trade facilitation improvement projects such as land expropriation for the construction of Economic Corridors a change occupation after the improvement of transportation and trade facilitation. Many of border communities and the poor cannot attain the benefit from transport and trade facilitation projects due to their lack of ability to adjust such as finance and knowledge. As a result, encroaching commercial enterprises from other areas may take the benefit of the projects instead. This situation brings about adverse effect on border communities as they lose business or employment from inability to compete.

To sum up, previous literatures find potential positive economic impacts of transport and trade facilitation projects on border communities and the poor. The potential benefits come from higher employment and new business opportunities. However, a lack of capital and skills impede them to fully attain benefits from the projects. As a result, the improvement of microfinance system in complementarity with transport and trade facilitation projects might accelerate poverty reduction from the trade facilitation projects.

IV. Scope of study

Mukdahan province (local communities neighboring the Route R9 and the second Thai-Lao Friendship Bridge) and NakhonPhanom province (local communities neighboring the Route R12 and the third Thai-Lao Friendship Bridge)

V. Conceptual framework and methodology

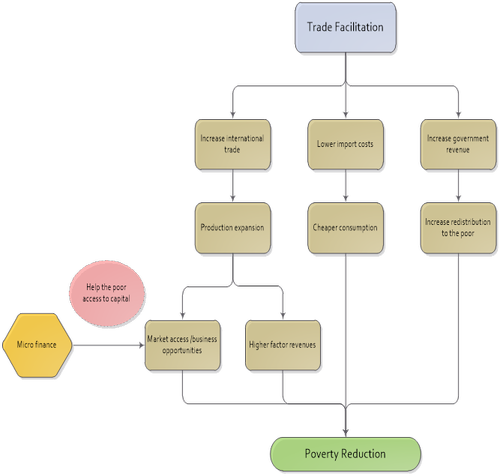

From previous literature, there are three main channels which trade facilitation contributes to poverty reduction. These channels are composed of trade expansion, cheaper consumption and higher government revenue. The contribution of trade facilitation on poverty reduction can be depicted in Figure 1.

Figure 1: The contribution of trade facilitation on poverty reduction

Source: Revised from Bin (2007)

Figure 1 shows that one of the important channels for trade facilitation to reduce poverty is from the expansion of production or service activities induced by greater international trade. The improvement in trade facilitation brings about lower trade transaction costs and time; hence, international trade is promoted. When production and service activities are expanded, the poor have more occupation opportunities. The opportunities come from both higher factor revenues and greater access to new businesses and markets. However, the poor and microenterprises may not have enough equity to set up or expand businesses in response to the opportunities that trade facilitation provides. As a result, microfinance can play an important role here. With the assistance of microfinance institutions to provide funding to the poor and microenterprises, they can better gain benefits from new business and new market opportunities coming from trade facilitation. The new business opportunities could promote their revenues. Therefore, microfinance can complement trade facilitation to lessen poverty.

The study will be conducted as follows:

1) The study will investigate goods or services that gain benefits from trade facilitation measures such as the goods or services exported using the Economic Corridors mentioned in the scope of study.

2) The study will identify which goods or services cause production expansion or activity expansion in Mukdahan province and Nakornpanom province.

3) The study will consider the involvement of the poor and border communities in the value chains of production or activities mentioned in 1) and 2).

4) If there is low involvement of the poor and border communities, the study will investigate the reasons and whether a lack of capital is among them.

5) The study will consider whether the current microfinance institutions provide loans that support the involvement of the poor and border communities in the production or service activities which are supported by trade facilitation measures. If not, the study will recommend the microfinance products that help the poor and border communities attain greater benefits from the trade facilitation measures.

To do so, we will conduct in-depth interviews with relevant stakeholders to attain the necessary information. The interviewed stakeholders are listed in Appendix.

To analyze the production or service activities that attain benefit from trade facilitation measures, the involvement of the poor and local communities in such production and activities, and the necessary supports they need for higher involvement, we employ the stakeholder analysis illustrated in Cheewatrakoolpong (2009).

The relevant stakeholders for this study composed of the poor, microenterprises, self-help groups, village funds, and saving groups in border communities of the two mentioned provinces, the government saving banks, the bank for agriculture and agricultural cooperatives, Chambers of Commerce, relevant government agencies such as border checkpoints’ officers, the office of commercial affairs, and the community development provincials.

Our analysis will define the following factors:

1) The needs and interest of each stakeholder for the utilization of trade facilitation measures and the involvement of the poor and local communities in the value chains that benefit from the measures.

2) The importance of each stakeholder for the greater involvement of the poor and local communities in the value chains that benefit from trade facilitation measures and the utilization of the measures to tackle poverty.

3) The influence of each stakeholder for the greater involvement of the poor and localcommunities in the value chains that benefit from trade facilitation measures and the utilization of the measures to tackle poverty.

Once we identify the sectors or activities that benefit from trade facilitation measures and the financial needs of the poor and border communities to increase their involvement in such sectors and activities, we will use the framework suggested by Brand (1998) and Cheewatrakoolpong et.al. (2011) to develop and improve the microfinance products and system that promote the utilization of trade facilitation initiatives.

According to Brand (1998) and Cheewatrakoolpong et.al. (2011), the development of microfinance products can be divided into three steps:

1) Product development

We need to design the characteristics of microfinance products, target groups, terms and conditions, pricing, and distribution channels.

2) Process development

The process development ensures that microfinance products can reach the poor efficiently and economically. This includes introduction of IT and capacity building.

3) Strategic development

The microfinance strategies ensure availability of microfinance products to the poor and the financial disciplines of the poor to the institutions’ commitments. The examples of the strategies are group-lending and social sanction.

The expected outcomes will be divided into two scenarios:

Scenario 1: Consider the current agricultural, manufacturing or service activities of the poor and microenterprises in border communities and find trade facilitation measures that can support those activities. Also, the role of microfinance to support the utilization of trade facilitation will be considered in complementarity.

Scenario 2: Consider the alternate production or service activities for the poor and microenterprises in border communities which can make them benefit from the current trade facilitation measures and reduce income gap or eliminate their poverty. Microfinance products and system that help them start those activities will be suggested.

Our hypothesis regarding sectors and service activities that benefit from trade facilitation measures is summarized as follows:

Hypothesis: the economic activities that help improve welfares of the poor and microenterprises and make them benefit from trade facilitation measures are:

a. Agricultural sectors: sugar canes, fruits, vegetables and cassava (These are the products that can be exported to China using the Route R9 and R12).

b. Service sectors: tourism, logistics and retail trading

VI. Overview of trade facilitation initiatives and microfinance system in Mukdahan province and NakhonPhanom province

This section gives the basic backgrounds regarding trade facilitation, economic situations and microfinance systems in Mukdahan provinces and NakhonPhanom provinces.

6.1 Trade facilitation measures

6.1.1 Mukdahan province

Mukdahan province is the important province of Thailand in the East-West Economic Corridor (EWEC) project under the GMS program. The EWEC intends to connect the Pacific Ocean with the Indian Ocean via the Asian Highway network at route AH16 from the Port of Da Nang and the city of Hue in Vietnam via Route number 9 and Savannakhet in Lao PDR and through Thailand’s Mukdahan, Kalasin, KhonKaen, Petchabun, Phitsanulok and Tak Provinces to Myanmar’s Gulf of Martaban in Moulmein with a distance of approximately 1,600 kilometres.

As a part of such program, the Second Thai-Lao Friendship Bridge betweenMukdahan province and Savannakhet province was built and completed in 2006.The bridge is of 2.7 kilometers. The bridge improves trade facilitation for cross-border and trans-border trade tremendously. Previously, the commercial trucks need to transit to Lao PDR’s border via a barge at Baan Na Po Noi. Using the barge to cross Mae Kong River required the waiting time around 45 minutes and spent approximately 90 minutes to 2 hours to reach the border of Lao PDR. The establishment of the bridge reduces the transit time tremendously and sharply promotes a number of transit trucks from approximately 17,000-18,000 trucks per year during 2002-2005 to 24,063 trucks and 42,226 trucks in 2006 and 2007 respectively.

As for custom procedures, the custom office and border crossing points in Mukdahan province is of international standard. It implements paperless system for custom procedures and uses x-ray for random product checking. The approximate total time to pass custom procedures and reach the border of Lao PDR is 16.1 minutes. Also, the border crossing points in Mukdahan is a part of the pilot project for the CBTA under the GMS program. It will have a single stop service and a common control area (CCA) in the future to reduce the duplication in custom procedures between the borders of Thailand and Lao PDR. The implementation of the CBTA is still waiting for Thailand’s ratification of some annexes and protocols.

6.1.2 NakhonPhanom province

NakornPanom province is a part of the Asian Highway Network on the AH15 line which connects Udornthani, Sakonnakorn and NakhonPhanom provinces in Thailand via Route 8 or Route 12 in Lao PDR to Vinh province in Vietnam. As complementarity to this project, the Third Thai-Lao Friendship Bridge connecting NakhonPhanom province in Thailand and Khammouan province in Lao PDR was built and officially opened on November 11, 2011. The bridge also supports traffic changeover due to the difference in traffic systems between Thailand and Lao PDR. The route shortens the distance between NakhonPhanom – Hanoi to 643 kilometers and between NakhonPhanom-Nanning to 1,029 kilometers.

Before the establishment of the bridge, shipping agencies and exporters relied on a barge to cross a border of Thailand to Lao PDR. The barge required approximately 15-20 minutes to reach Lao PDR, depending on the level of Mae Kong River and congestion. The barge can transit approximately 30 trucks per hour.

As for custom procedures, the paperless system is implemented here without an x-ray machine. The custom procedures totally take approximate time of 16.7 minutes. The new Thai customs checkpoint office at the bridge is under developed.

The future plan at the NakhonPhanom border checkpoints also include the implementation of single stop inspection, the establishment of by-pass highways to connect Route 22 with Route 212 to avoid congestion in the urban area, and the construction of logistics and distribution centers nearby the bridge to facilitate trans-border and cross-border activities.

6.2 Current economic situations

1)Mukdahan province

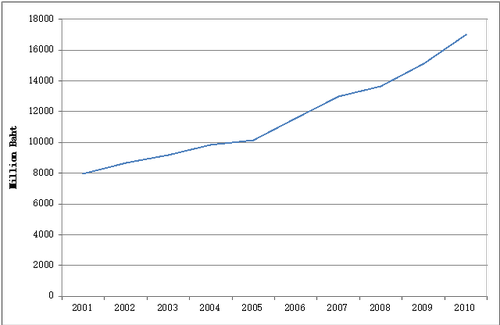

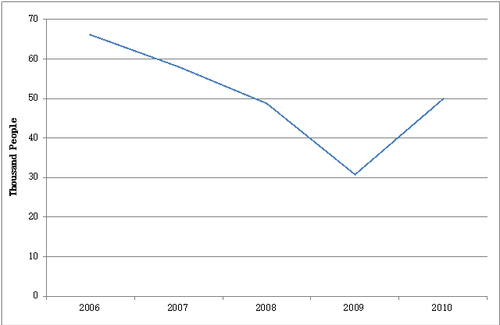

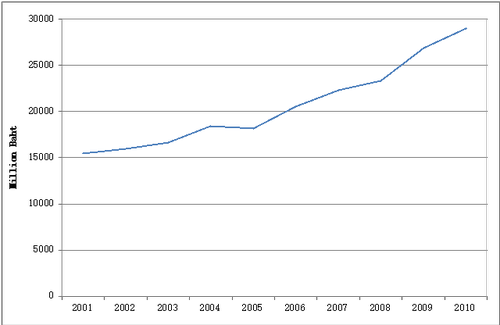

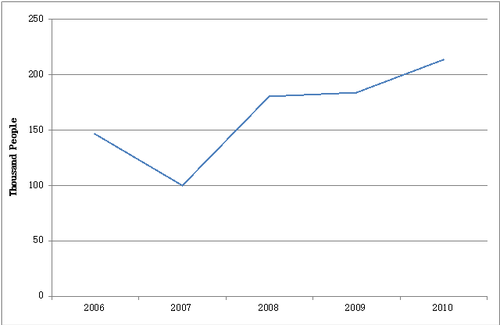

Mukdahan province is the border province of the Northeastern region that benefits from trade facilitation measures tremendously. The evidence of gross provincial products (GPP) and a number of people under the poverty line confirms such benefits as shown in Figure 2 and 3. The province experience higher growth in GPP and a drop in a number of people under the poverty line since the establishment of the Second Thai-Lao Friendship bridge.

Figure 2: Gross provincial products in Mukdahan

Source: National Statistical Office

Figure 3: A number of people under the poverty line in Mukdahan

Source: Office of the National Economic and Social Development Board

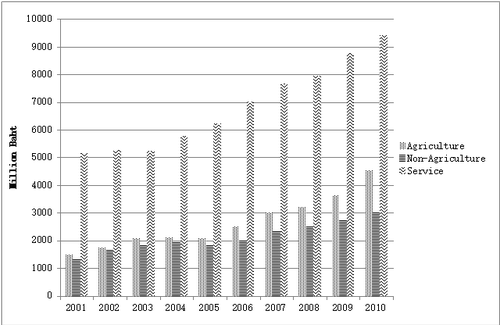

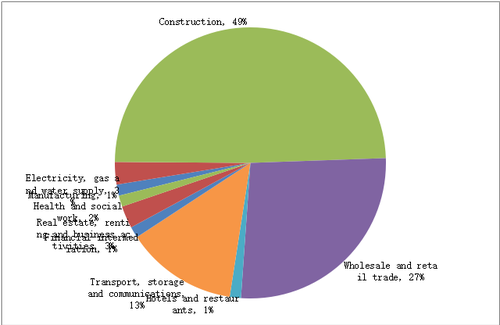

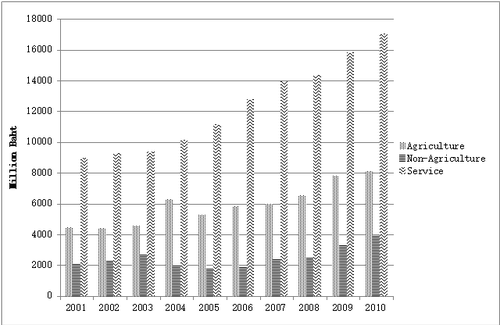

Considering the sectoral GPP, Mukdahan province is concentrated on agricultural and service sectors as indicated in Figure 4. The notable agricultural products are rice, rubber and sugar cane while the important service sectors are construction, retails and wholesales, logistics, hotels, residential services and health care services as shown in Figure 5. Figure 4 also depicts the benefits that both agricultural and service sectors attain after the implementation of trade facilitation initiatives in 2006.

Figure 4: Gross Provincial products by economic activities in Mukdahan

Source: Office of the National Economic and Social Development Board

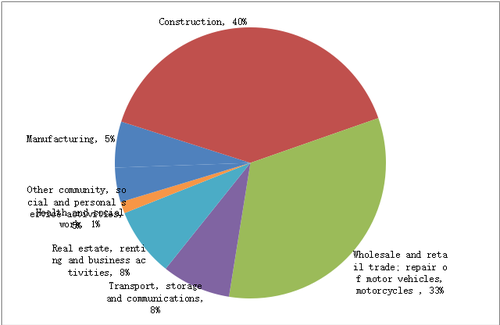

Figure 5: The establishment of juristic person in Mukdahan province in 2008

Source: National Statistical Office

Considering cross-border trade, we observe the promotion of such trade via the establishment of the Friendship bridge. Since the completion of the bridge in 2006, total cross-border trade in Mukdahan increases significantly as shown in Figure 6. The important cross-border trade products include electronics and electrical appliances, energy, consumer products, automobiles and livestock as indicated in Table 1.

Figure 6: Cross-border Trade in Mukdahan

Source: Bank of Thailand

Table 1: The top-ten cross-border in Mukdahan in 2010 (Million baht)

|

rank |

products |

value |

|

1 |

Computers and parts |

7,328.56 |

|

2 |

Storage units |

2,258.26 |

|

3 |

Oil and gasoline |

1,444.43 |

|

4 |

Drilling machineries and containers |

1,362.54 |

|

5 |

Consumer products |

1,275.12 |

|

6 |

Electrical appliances and electronic parts |

492.27 |

|

7 |

Cows |

488.07 |

|

8 |

Automobiles |

285.57 |

|

9 |

Monosodium glutamate |

249.75 |

|

10 |

Energizing beverage |

234.13 |

|

|

Others |

4,852.29 |

|

|

Total |

20,270.99 |

Source: Mukdahan office of customs

2)NakhonPhanom province

The impact of trade facilitation measures in NakhonPhanom province remains unidentified as the construction of the third Thai-Lao Friendship bridge was completed in 2011. However, even before the completion of the bridge, Route 12 is utilized for transportation of several products to Vietnam and China including fresh fruits.NakhonPhanom has experienced an increase in economic growth for several years but a number of people under the poverty line is rather increasing as shown in Figure 7 and 8. The evidence indicates unequal distribution in economic growth among people in the provinces.

Figure 7: Gross provincial products in NakhonPhanom

Source: Natio nal Statistical Office

Figure 8: A number of people under the poverty line in NakhonPhanom

Source: Office of the National Economic and Social Development Board

Similar to Mukdahan, NakhonPhanom has experienced a sharp increase in the service sector while the manufacturing sector remains constant over the past years as illustrated in Figure 9. The notable service activities are construction, retails and wholesales, repairs of motorcycles and vehicles, logistics, real estate and renting services and health care services as seen in Figure 10.

Figure 9: Gross Provincial products by economic activities in NakhonPhanom

Source: Office of the National Economic and Social Development Board

Figure 10: The establishment of juristic person in NakhonPhanom province in 2008

Source: National Statistical Office

Cross border trade is relatively low in NakhonPhanom than in Mukdahan but the statistics show constantly higher growth as depicted in Figure 11.The important cross border export products passing NakhonPhanom’s border are oils and gasoline, construction materials, pet food, livestock, machinery and automobiles and automotive parts. The statistics are shown in Table 2.

Figure 11: Cross-border Trade in NakhonPhanom

Source: Bank of Thailand

Table 2: The top-ten cross-border in NakhonPhanom in 2009 and 2010 (Million baht)

|

Products |

Export Value |

|

|

2009 |

2010 |

|

|

1. Diesel fuel |

861.72 |

440.18 |

|

2. Automobiles and automotive parts |

458.29 |

192.04 |

|

3. Iron and steel |

356.94 |

279.88 |

|

4. Iron and steel products |

336.65 |

186.86 |

|

5.Pet food |

186.3 |

102.9 |

|

6.Gasolines |

179.53 |

87.28 |

|

7. Construction machinery and parts |

142.53 |

269.93 |

|

8. Livestock |

120.3 |

123.75 |

|

9. Other machinery and parts |

83.18 |

34.76 |

|

10. Other vehicles and parts |

73.82 |

124.33 |

|

Others |

1911.99 |

1079.5 |

|

Total |

4,711.2 |

2,921.4 |

Source: NakhonPhanom office of customs

6.3 Microfinance system

The microfinance system in Thailand was poorly developed as proven during the 1997 financial crisis that financial institution and intermediaries in Thailand served mainly last enterprises. The development of microfinance system in Thailand has initiated in 2001 from a launch of million baht village funds. Around that time, the Bank of Thailand implemented the financial system development plan for the period of 2004-2009. One of the principles in the development plan is to promote the coverage of financial services to all people. This results in the implementation of the microfinance master plan in Thailand during 2008-2011. The involved microfinance institutions according to the master plan are composed of the Government Saving Bank (GSB) and the Bank for agriculture and agricultural cooperatives (BAAC), village funds, saving groups and other informal financial institutions. The semi formal and informal financial institutions are supported by the offices of community development provincials. The current microfinance master plan for the period of 2010-2014 also promotes the involvement of commercial banks in microfinance services, the development of microfinance infrastructure including credit information system and rating system, and the promotion of the specialized financial institutions.

Even though the microfinance master plans have been implemented for several years, the microfinance system in Thailand is still under developed. The Economist Intelligence Unit (2011) assigns ratings to microfinance markets in 55 developing countries and reveals Thailand in the rank of 50. The sources of problems come from the fact that microfinance activities are concentrated in the government banks which have several missions other than microfinance. Also, the interest ceiling of 28% annually prohibits the involvement of other commercial banks in microfinance services. The development of semi-formal or informal microfinance institutions is inconsistent and depends on the government’s policies. Finally, there are no formal financial institutions with microfinance services as their main goal.

According to the community development department, 47% of saving groups in 2010 are located in the Northeastern region. However, most of the saving groups in this region are weaker than the groups in other regions of Thailand. Cheewatrakoolpong et.al.(2011) shows that the Northeastern people with low incomes mostly depend on the BAAC for financing purpose. About 35% of poor people in the Northeastern have no financial access to both formal and semi-formal financial institution. Also, 69% of poor people with no financial access rely on shark loans. Table 3 depicts a number of branches of formal financial institutions that provide microfinance services in Mukdahan and NakhonPhanom. The figures indicate the low coverage of such services in the provinces.

Table 3: A number of GSB and BAAC’s branches in Mukdahan and NakhonPhanom

|

|

NakhonPhanom |

Mukdahan |

The Whole kingdom |

|

GSB Branch |

11 |

5 |

998 |

|

BAAC Branch |

10 |

6 |

1159 |

Source: GSB and BAAC

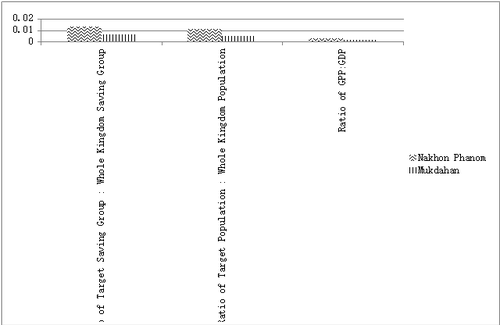

Considering Mukdahan and NakhonPhanom provinces, both provinces have a large number of saving groups comparing to their sizes both in terms of GPP and population as seen in Figure 12. However, Figure 13 shows that most of the saving groups are relatively weak as classified in Class 3.

Figure 12: Ratio of saving groups, population and GPP in 2010

Source: Community Development Department and National Statistical Office

Figure 13: A number of saving groups categorized by the group level

Source: Community Development Department

Also, the interviews with the offices of community development provincials and saving groups in the provinces indicate that the saving groups in the provinces concentrate more on saving activities and have limited capacity for lending activities. The evidences can be found in Table 4 and 5 illustrating a number of village funds, saving groups, occupational groups and other types of community groups in Mukdahan and NakhonPhanom that give loans.The more details on this issue will be illustrated in the next section.

Table 4: Semi-formal and informal microfinance groups and their ability to grant loans in Mukdahan, AmphorMuang

|

|

total group |

given credit group |

value of credit |

|

Village Fund |

20 |

9 |

9,831,700 |

|

Poverty Alleviation Fund |

14 |

6 |

1,712,560 |

|

Saving Group |

10 |

4 |

2,260,500 |

|

Occupational Group |

11 |

1 |

141,000 |

|

Other |

37 |

2 |

509,353 |

Source: Cheewatrakoolpong et al. (2011)

Table 5: Semi-formal and informal microfinance groups and their ability to grant loans in NakhonPhanom, Amphor That Phanom and AmphorRenuNakorn

|

|

Total group |

Given credit group |

Value of credit |

|

Village Fund |

21 |

7 |

6,224,500 |

|

Poverty Alleviation Fund |

13 |

4 |

823,108 |

|

Saving Group |

19 |

2 |

911,300 |

|

Occupational Group |

8 |

1 |

57,600 |

|

Other |

38 |

1 |

40,000 |

Source: Cheewatrakoolpong et al. (2011)

VII. Survey results

In this section, we illustrate the survey results. The details of the survey and interviewed stakeholders are shown in the appendix. The purpose of the survey is to identify, the impact of trade facilitation measures in Mukdahan and NakhonPhanom provinces to the poor, the opportunities of the poor from trade facilitation measures, the obstacles for the poor on financial access and otherobstacles for the poor to attain benefits from trade facilitation measures.

7.1 Impact of trade facilitation measures on the poor

This study considers the impact of trade facilitation measures in the two provinces on the poor by dividing such effect into 4 categories, namely, the impact on overall economic growth and income of the poor in the provinces, job creation and job diversion, migration and foreign expatriation, and social impacts.

7.1.1 Economic growth and income

Our interviews with relevant stakeholders, including provincial government agents, entrepreneurs and villagers, confirm that the construction of the Thai-Lao Friendship bridges in both provinces and the implementation of other related trade facilitation initiatives promote economic growth in the provinces and income of the people in the provinces. This comes from several factors listed as follows:

(1) Job creation

Trade facilitation initiatives bring about job creation in several sectors which will be illustrated in the next point. The job creation leads to more employment, higher wages and higher profit for entrepreneurs and microenterprises which promote economic growth and well-being of the people in the provinces.

(2) An increase in investment

The implementation of trade facilitation measures and the better assess to neighboring countries make the two provinces attractive for several investors. There are plenty of investment projects and business start-up in the two provinces ranging from food and agricultural processing industries, superstores, restaurants, hotels, hospitals, logistics, and recycling industries, retails stores, and many more from the investors in other regions of Thailand so as the investors from neighboring countries like Vietnam. An increase in investment brings about more employment opportunities, higher wages, and more variety of job opportunities.

(3) More people visiting the provinces

Trade facilitation measures make transportation between the provinces and the neighboring countries, including Lao PDR, Vietnam, and the Southern China, more convenience. This leads to more people, both from other provinces of Thailand and from neighboring countries, visiting the provinces for business, travelling, employment, shopping and other purposes. The more people visiting the provinces, the better economic growth as they have to spend money for eating, accommodation, travelling, transporting, and shopping. This consequence of trade facilitation measures also promotes job creation as well.

(4) An increase in land and real estate prices

Trade facilitation measures lead to higher asset prices in the provinces, especially in land and real estate prices. An increase in asset prices improves the living status of people in the two provinces, particularly at border communities. According to the interview, there is a gigantic increase in land prices at the border location, especially around the bridge’s vicinity. For example, there is an increase in land prices in the area surrounding the third Thai-Lao Friendship Bridge by more than 4 times comparing with before the completion of the bridge. Many villagers at Baan Hom, the closest border community to the bridge, gain a large sum of money by selling their land. However, the long term effect of the bubble prices in land and real estate on border communities might not be positive as many of them sell their own land to speculators and corporate enterprises from other regions and have to start up their occupation again in other unfamiliar regions.

7.1.2 Job creation and job diversion

As mentioned in 7.1, the implementation of trade facilitation measures brings about job creation, both in terms of positions and varieties. However, in some cases, it destroys the opportunities of some occupations in the provinces due to more competitions from foreign expatriate, both from other regions in Thailand and neighboring countries. We pay our attention in agricultural and agricultural processing sector and service sector as described below.

(1) Agricultural and agricultural processing sector

Agriculture is originally the most important sector of the two provinces in our case study, so as other provinces in the northeastern region. In the past, rice, sugar cane and tapioca are the economic agricultural products of the provinces. Recently, there is an increase in rubber plantation and rubber processing industries in the two provinces.

The establishment of trade facilitation measures in the two provinces facilitates transportation of agricultural products, both originated from the two provinces and transited from other regions in Thailand, to China and Vietnam. China is a major importer and consumer of agricultural products such as rice, tapioca and rubber, which can be produced in the two provinces. Therefore, the measures increase the opportunities for rural and border communities in the provinces to assess the markets in the two mentioned countries. Besides, according to the interview, Mukdahan province is used as the center for rubber processing industries and rubber distribution in the northeastern region due to its location advantage.

Both China and Vietnam also needs to import fresh fruits from Thailand. Therefore, the exporters from other regions of Thailand depend on trade facilitation measures in these two provinces for transportation of their products to Southern China and Central Vietnam. The exports of these products create opportunities for logistics and transport business in the provinces. Before the establishment of Route 12, it is not possible to export fresh fruits to Southern China due to the long shipping time makes the fruits rotten. Therefore, trade facilitation measures create new markets to such products. Also, fresh fruits exported to Vietnam can be sold at higher prices since the quality is better from shorter exporting time.

Moreover, even though there exist tariff and non-tariff barriers on rice in Vietnam and China, according to the interview with chambers of commerce and provincial developers, both countries have high interest on the import of organic rice from the provinces. The organic rice is produced by rural and border communities and it creates high value added. With the package size within 1 kilogram, the organic rice is allowed to export to Vietnam and China.

Another opportunity in the agricultural sector is contract farming with Lao PDR. As Lao PDR is gifted with natural resources with plenty of nourished lands for plantation, investing in agriculture and agricultural processing industries in this country is promising. The notable agricultural and agricultural processing products are rice, rubber, livestocks, sugar cane and sugar, soybean and soybean oil.

However, according to the interview, the major obstacle for the poor or microenterprises to invest in Lao PDR comes from the requirement of long-term expertise and skills in such production from the Lao government and the need of huge capitals to set up business there.

(2) Service sector

According to the interview, a service sector attains the highest positive impact from the implementation of trade facilitation initiatives in the two provinces. The Thai-Lao Friendship Bridges in both provinces lead to the occurrence of several jobs in the service sector, especially in tourism industries, hotels and restaurants, logistics services, retails and wholesales, education, and health care services.

As for tourism related services, the establishment of the bridge and other trade facilitation measures leads to convenient transportation between the two provinces and Lao PDR. Also, the improvement and establishment of Route 9 according to the East-West Economic Corridor shortens the travelling time to Southern Vietnam. As a result, travelling along the Route 9 to Southern Vietnam has become famous among tourists from other regions of Thailand. The Vietnamese people also use such Route to travel to Thailand. The creation of Savan Vegas, one of the biggest casinos in Lao PDR, in Savannakhet also attracts many Thai tourists and gamblers to visit Mukdahan province.

Due to an enormous increase in tourists, businessmen, gamblers and visitors who transit Mukdahan and NakhonPhanom provinces in order to visit Lao PDR and Vietnam, the tourism related businesses have been prosperous during the recent years. The sectors that benefit the most include tour guides, tour cooperators, hotels, restaurants, car and van rental services, and drivers. According to the interview, there have been a distinctive rise in such businesses and services in Mukdahan province. Both the private sector and local communities experience an obvious rise in a number of hotels, restaurants, coffee shops, tour guide services and car rental services. Moreover, according to the interview with the tour cooperators in Mukdahan, they confirm a sharp increase in a number of tourists from other regions in Thailand, leading to business expansion and the establishment of tour cooperation with Vietnamese tour guide companies. The interview with a tour driver also indicates that there is huge job creation in such services in Mukdahan which promotes the opportunities for the villagers to go back and work at their own province.

However, it is worth to note that there is a difference between the promotion of tourist related services between Mukdahan province and NakhonPhanom province. In NakhonPhanom province, such benefits are still not conspicuous due to two main reasons. First, the bridge in NakhonPhanom was just completed in November, 2011. Second, Khammouan province, NakhonPhanom’s twin city in Lao PDR is a small province with less population comparing with Savannakhet. Also, although there are many ecological tourist attractions along Route 8 and 12, it is still hard to access those attractions. However, according to the interview, both provincial government agents and the private sector expect high growth in this sector in the future after the more development of infrastructure on both sides.

Logistics services also attain huge benefits from the establishment of trade facilitation measures in the two provinces. The second Thai-Lao Friendship bridge in Mukdahan and Route 9 is a part of the East-West economic corridor connecting Myanmar, Thailand, Lao PDR to Vietnam and the Danang sea port. The third Thai-Lao Friendship bridge connects NakhonPhanom province with Route 8 and 12 in Lao PDR which can transit to Hanoi, Vietnam and Nanning of Southern China. As a result, both provinces can be used as outlets to transport products and people to Lao PDR, Vietnam and China. The notable products that heavily utilize these routes are fresh fruits, construction materials, fertilizers, consumer products, electronics and electrical appliances and automotive parts. According to the interviews with the provincial chambers of commerce, logistic services are one of the businesses that hugely establish after the creation of the bridges. The occurrence of such services creates employment tremendously in terms of drivers, office workers and operational workers.

The impact of trade facilitation measures on retails and wholesales services are mixed. According to the interview, these services might experience negative impact from the implementation of trade facilitation measures. Before the establishment of the bridges, microenterprises in Mukdahan and NakhonPhanom provinces can transport via boats to sell consumer products in Lao PDR. However, the bridges make transportation from Lao PDR to Thailand more convenient so Lao People can come to buy consumer products from superstores by themselves. Also, trade facilitation measures bring about economic growth in the province which is accompanied by the set up of superstores in the provinces. The occurrence of superstores eradicate retails and wholesales businesses of microenterprises.

In contrary, according to the interview, there are some specific retails and wholesales services that benefit from trade facilitation measures. The microenterprises selling packaging and containers gain huge benefits from trade facilitation measures since many products such as silk, fermented mud cloth, indigo dye cloth and wicker baskets have more sales orders after implementing trade facilitation measures. The wholesales enterprises selling automotive parts, IT products and electrical appliances also attain greater sales volumes from Lao PDR and Vietnam.

Considering educational services, the interview explores that there are many Vietnamese students come to study tourism management and Thai language to become tourist cooperators. Also, many Lao and Vietnamese students come to study at vocational training schools in both provinces. It is worth to note that most Lao students get scholarship to pursue their study in Thailand under the capacity building projects of the GMS program. The Lao people from wealthy families should to attain their study in the bigger provinces such as SakonNakhon instead. The successful educational programs attracting Vietnamese and Lao students are short courses regarding tourism, hotel management, technicians and mechanics.

Health care services also attain positive impact from trade facilitation measures. According to interview and observation, there is an increase in health care providers and clinics in Mukdahan provinces. Many patients receiving therapy from hospitals and clinics in these provinces come from Lao PDR and Vietnam. However, it is important to note that some of the patients from the neighboring countries receive free health care services as a part of benefits for foreign workers from the neighboring countries in Thailand. The interview with health care providers in border communities indicates potential problems of under capacity of health care services as the providers find subrogation of such benefits by foreign workers’ family members or relatives.

(3) Local products

Many producers of local products and OTOP products attain huge benefits from trade facilitation measures. According to the interview with the OTOP group and the chambers of commerce, there are many local products and OTOP products that can be exported to Vietnam and China. The high potential products include organic rice in a small package, silk, fermented mud cloth, indigo dye cloth, cattle breeds in Amphor Nong Sung and wicker baskets. Some products such as fermented mud cloth have received high export sales volumes. Also, some OTOP groups and local communities can import materials such as rattan, wood, and cloths are imported from Lao PDR.

However, according to the interview with both the chambers of commerce and the OTOP groups, we found that there are some obstacles for local communities, OTOP groups and microenterprises to attain such opportunities, mainly from lack of capitals, management and marketing skills, financial knowledge, designing skills and manpower.

7.1.3 Migration and foreign expatriation

Trade facilitation measures lead to migration from both neighboring countries and other provinces of Thailand and foreign expatriation.The purposes of migration and foreign expatriation are ranging from labor migration, investment, permanent residence migration and asset speculation. In this study, we divide the effect into labor migration and other types of migration of foreign expatriation.

(1) Labor migration

Similar to other provinces of Thailand, Mukdahan and NakhonPhanom provinces are facing lack of operational workers especially in housekeepers, servants, waitresses, workfolks and other manual laborers. As a result, there is labor movement from Lao PDR to the provinces. Labor migration is intensified by the Thai wage increase policy which raises wage rates of foreign workers. The interview indicates that labor migration does not result in unemployment of local people as foreign workers fulfill the positions that the local workers do not work.

However, the interviews with microenterprises and local workers show that labor migration from the neighboring countries might cause a slow increase in local workers’ wage rates. Many of local workers still get wages lower than the official minimum wage. Even though the provinces face the shortage of local labor supply, foreign workers fulfill vacant job positions. Therefore, wage rates do not increase much. Labor migration affects income of blue-collar workers the most from our surveys.

Some foreign workers also work as skilled labor. The examples are Vietnamese people who come to work as tourist coordinators for tour guide enterprises in the provinces.

Unlike some other provinces, labor migration in Mukdahan and NakhonPhanom provinces does not cause higher crimes. However, migration leads to other problems like prostitution and diseases which will be discussed in the next section.

(2) Foreign expatriation

Other causes of the movement of people to Mukdahan and NakhonPhanom provinces are investment, land speculation, and permanent residence movement due to business opportunities. These types of movement mostly come from Thai people living in other provinces.

As for investment aspects, there are the establishment of several industries and commercial enterprises ranging from small to big ones. The big enterprises are composed of rubber processing industries, tapioca processing industries, recycling industries, logistics services, hospitals, superstores and distribution centers. There are also small enterprises move to open businesses there such as restaurants, coffee shops and tour guide services. Such investment promotes employment, income and economic growth of the provinces.

However, the interviews also indicate the movement of people from land speculation motive. Many come to buy up land surrounding the bridge projects, causing bubble asset prices and the local communities to lose their plantations. The evidence of bubble land prices is obvious in NakhonPhanom province since the land prices in Baan Hom, the closest communities to the Third Thai-Lao Friendship Bridge, increase more than 4 times comparing with the prices before the implementation of such project. The interview also indicates that the same phenomenon happened at the time the Second Thai-Lao Friendship Bridge was completed in 2006. The land prices in the areas surrounding the bridge decreased after the bubble burst. However, economic growth in the province makes real estate prices in the urban area of the province increase later.

The last purpose of people movement is the permanent residential movement of Thai people from other provinces, especially in the Northeastern region. Many of them permanently move to the provinces to seek business and career opportunities so as to improve well-being of their family as trade facilitation measures are accompanied by more employment opportunities, better infrastructure, improved educational and health care services and other development aspects.

7.1.4 Social impacts

Trade facilitation measures bring about economic growth and better employment opportunities. On the other hand, they also cause immediate changes in culture and ways of living which require local communities to adjust themselves into the new environment. Among the social changes are negative impacts such as gambling, drugs, contagion and diseases, and prostitution.

(1) Gambling

Gambling is one of the most concerns from all stakeholders as a result of trade facilitation measures in the provinces. Casinos are prohibited to open in Thailand by the Thai law but there is a big casino in Savannakhet called “Savan Vegas”. Also, another casino is planned to open in Khammouan. The easy access to casino causes a gambling-addicted problem to many local people in Mukdahan. Most gambling-addicted people are the poor and middle-income such as provincial government officers, teachers, nurses, and manual workers.

The gambling problem brings about several problems such as suicide, robbery, crimes, drug trafficking, human trafficking, immeasurable debts, and poverty. The interviews and news reveal that many gamblers commit car robberies, drug trafficking, and human trafficking in order to repay their debts. Some committed suicide due to myriad gambling debts.

Furthermore, the casino uses the network system to bring more clients from all over regions in Thailand. The van drivers are paid when they can persuade more clients to visit the casino. There is also limited control from Thai government on casino visits from Thai people. We experienced enormous and openly advertisements of the casino in many modes such as on sky lab cars and taxis. The people who pass the border checkpoint to visit the casino are facilitated rather than controlled. There are even supporting facilities for the people to visit the casinos such as banks, ATM machines, and rental cars and vans at the border crossing areas.

(2) Drug trafficking

Drug trafficking in Mukdahan and NakhonPhanom provinces come from two main reasons. First, as mentioned above, many gamblers attempt to traffic drugs in order to repay their debts. Second, the intense suppression of drug trafficking and stricter controls at other border crossing points such as Mae Sod, Tak province and Mae Sai, Chiang Rai province make drug dealers try to use the other border crossing points like Mukdahan and NakhonPhanom for their drug trafficking.

(3) Diseases

Labor migration from Lao PDR causes concern regarding health issues. As Lao PDR is underdeveloped in term of health care system, labor migration may cause the spread of contagion, some of them have disappeared from Thailand. Some of health care providers also concern about the subrogation of foreign workers’ health care benefits as a number of foreign people who received the benefits are more than a number of registered foreign workers. The subrogation problem causes a burden on public budget and under capacity of health care providers.

(4) Prostitution

Prostitution is another concern from all stakeholders as a result of trade facilitation measures. The Friendship Bridges and other complement road link alignment improve transportation between Thailand and Lao PDR. However, some Lao women come to the provinces to provide sexual services. Prostitution by Lao women is practiced openly in many areas such as the glass tower in Mukdahan province. Also, there is a formation of sex tour to bring local Thai communities in the provinces to visit prostitutes in Lao PDR. The accompanied problem is also the spread of HIV.

(5) Loss of residential and work places

According to the interview, the construction of the bridge and the related projects such as the establishment of customs offices, distribution centers and product exhibition centers require land expropriation from local communities such as Baan Hom. Some of the villagers here occupy the land without propriety right but they live there for several generations. The expropriation comes with little compensation, slow process of dispute settlement with provincial government agents and a lack of a plan to alleviate the negative impact for local communities. Recently, the Member of Parliament of NakhonPhanom has to act as a mediator to solve such problem by offering the villagers substitute plantation and residential areas.

7.2 Opportunities for the poor from trade facilitation measures

Section 7.1 explores several opportunities for the poor and microenterprises. This section concludes such opportunities.

The opportunities accompanied with trade facilitation measures in the provinces come from agriculture, service sector and investment. For agriculture, there are more demands from Vietnam and China in agricultural products especially in organic rice, tapioca, rubber, sugar and fresh fruits.

Considering the service sector, there are more job and business opportunities in this sector especially in tourism related services, hotels, restaurants, logistics, educational services and health care services. The mixed results are found in retails and wholesales but some opportunities are observed such as packaging and containers, automotive parts and electrical appliances.

There are also opportunities to sell local and OTOP products such as silk, fermented mud cloth, indigo dye cloth and wicker baskets to Vietnam and China.

There are also investment opportunities in Lao PDR such as contract farming, agricultural processing, restaurants, and other retails services. However, there is limitation for the poor to such investment due to the requirement of huge capital to set up the business and complication of rules and regulations for foreign ownership of businesses there.

Trade facilitation measures also facilitate transportation between Thailand and the neighboring countries such as Lao PDR, Vietnam and Southern China. Such opportunities promote tourism, exporting activities, labor movement and investment.

7.3 Financial access of the poor and microfinance system

The major microfinance institutions in the provinces are the bank the Government Saving Bank (GSB) and the Bank for agriculture and agricultural cooperatives (BAAC). The GSB aims to provide micro credits in the urban areas like vendors in fresh food markets via the People Bank Project. Micro credits in the People Bank Project are in forms of group lending. The loan terms are flexible with the duration up to 8 years with the flat interest rate of 0.5-0.75% per month. The maximum loan amount is 200,000 bahts. However, the bank experienced high non performing loans in this project due to weak social linkages among borrowers in the same group. As a result, the GSB branches tend to limit the micro credits under the People Bank Project to previous customers with decent saving history. The GSB also changes the conditions of loans from group lending to the requiredment of 2 guarantors. Some of the branches lend money according to the People Bank project to employees with guarantors instead of vendor groups in the markets. The interview with the GSB in NakhonPhanom reveals that the lending to vendors in the markets are accounted for only 20% of the total loans under the People Bank Project.

Another type of microfinance services provided by the GSB is the rural development project which provides loans for saving groups and village funds. However, according to the interviews with GSB officers, the project is unsuccessful. There are no loans according to this project in the branch in AmphorMuang, Mukdahan since the strong groups have no need to depend on external finance and the small groups are not strong enough to attain loans from the GSB. The GSB in NakhonPhanom informs high non-performing loans in this project.

The BAAC aims to give loans to farmers and their families with low interest rates and flexible loan conditions. However, the loans are limited to farmers with the proprietary right of land. As a result, poor farmers and agricultural employee might not be able to access the loans provided by the BAAC.

Both the GSB and the BAAC experience an increase in microfinance loans after the implementation of trade facilitation measures in the provinces. Many farmers request loans for plantation of sugar crane and rubber. Trade facilitation also increases sales volumes in fresh food markets and the Indo-China market which increase the ability to repay debts for vendors in those markets.

Other types of microfinance institutions are village funds, saving groups and women groups. However, the interviews with related government agents and banks explore that the groups in the provinces are relatively weak comparing with the saving groups in other regions of Thailand. The committees of the strong groups have an attitude to depend on the groups’ savings than external finance and follow the philosophy of sufficiency economy. Some of local communities also rely on their children who seek jobs in the big cities and send money back home. Therefore, they have no intention to ask for loans and expand business on their own. However, some members of the groups claim that they receive loans from the village funds and saving groups less than what they need. Also, if they use the loans for occupation purpose such as raising farm animals and buying materials, the loans can improve their well-being and raise their financial status. The difficulties come from the fact that many members of the groups use loans for consumption such as buying cars instead. This finding confirmsTownsend (2011) which states that the “Million baht village” project has highest impact on short-term credits and consumption but deteriorates overall asset growth.

On the demand side, the interviews recover limited financial access of the poor and microenterprises in the two provinces. According to the interviews, microenterprises face difficulties of obtaining loans from financial institutions due to a lack of required collaterals or guarantors, the complication of required documents, a lack of commercial registration, and a mismatch between loan amount and maturities that financial institutions grant and those that microenterprises need. As a result, microenterprises depend more on their equity to run their businesses. Many microenterprises raise financial access as a major obstacle to expand their business.

The poor local workers, vendors, OTOP groups and farmers without land face even more problems concerning finance assess as it is difficult for them to find collaterals or guarantors. Financial assess is regarded as one of the main obstacles for the poor and microenterprises to fully obtain benefits from trade facilitation measures as they have no capitals to expand their business or set up new businesses.

7.4 Other obstacles for the poor to attain benefits from trade facilitation measures

Even though financial access is the major obstacles for the poor and microenterprises to attain the benefits from trade facilitation measures, there are other obstacles that make improvement in microfinance alone is not enough to help the poor and microenterprises. The important obstacles are a lack of management, marketing and designing skills of the poor and microenterprises to make their products more suitable for final consumers in Vietnam and China. They also lack of economic and market knowledge. Therefore, they need the support in terms of capacity building, business matching, and integration into supply chains in order to fully attain benefits from trade facilitation measures.

VIII. Stakeholder analysis

In this section, we will identify interest, impact, influence and importance of relevant stakeholders in order to make the poor and microenterprises obtain more benefits from trade facilitation measures. The relevant stakeholders for the implementation of trade facilitation measures on the purpose of poverty reduction are composed of provincial government agents, provincial developers, a chamber of commerce, formal microfinance institutions, semi formalor informal microfinance institutions, big and medium enterprises, microenterprises, and local communities.

8.1 The provincial government agents

The most important provincial government agents responsible for poverty reduction of the provinces are office of community development provincials and provincial developers. They are responsible for rising standard of livings and eradicating poverty of local communities. To do so, they promote occupations of local communities via skill training and market seeking for local products. They also give training on financial disciplines and financial literacy via many programs such as coordinating the establishment of saving groups, creating sufficiency economy villages.

Other relevant government agents are as follows:

1) Highway district offices are responsible for the formulation and implementation of trade facilitation measures related to the provinces.

2) Office of customs and Immigration and Custom Quarantine (ICQ) units at the borders are responsible for border crossing and customs procedures.

3) Provincial offices of commercial affairs are responsible for the promotion of commercial activities and economies of the provinces, supporting and facilitating the provincial enterprises in terms of trade, investment and the utilization of commercial privilege rights.

However, the above mentioned government agents have minor roles on poverty reduction comparing with the office of community development provincials and provincial developers. The stakeholder analysis for the government agents is as follows.

Interest: the provincial government agents especially the offices of community development provincials and provincial developers have high interest on the mission of poverty reduction. According to our interviews with the agents, most of them are well-educated local communities who want to promote the well-being of their own communities. They have good linkages with the local communities via regular community visits and skill training activities. Their concern about the target of poverty reduction is policy consistency from the central government. The interviews reveal that the central government’s policies and projects have altered several times especially when there is a change in ministers or cabinets. A lack of policy consistency causes hardship for provincial developers to achieve the mission of poverty reduction. One example is the implementation of the debt moratorium project obstructs the long-term training of financial disciplines for farmers and villagers.

Importance: Poverty reduction and the greater involvement of local communities to utilize trade facilitation measures to promote the well-being are important to the office of community development provincials and provincial developers but not all provincial government agents. The example of land expropriation in Baan Hom communities indicates that some government agents have low priority on communities’ well-being as the land expropriation is executed without proper compensation and a relocation plan to the communities until there is intervention of The Member of Parliament. The local government agents give high priority on legal issues and the success of the projects in the long run than the welfare of communities adversely impacted by the projects.

Influence: The provincial government agents are one of the key success factors for poverty reduction and the promotion of the utilization of trade facilitation measures on this cause. The provincial government agents bridge the gap between the central government and local communities. The offices of community development provincials and provincial developers have direct responsibilities for the promotion of communities’ occupation opportunities that occur from many reasons including trade facilitation measures. They also help establish village funds and saving groups which provide financial access to the poor and local communities. If the provincial government agents have strong social linkages with local communities, it is easier to achieve the central plan for poverty reduction. If provincial government agents lack of determination and heedfulness to help local communities, the mission of the promotion of local communities’ welfare and poverty reduction might not be successful.

8.2 The Member of Parliament (MP)

The Member of Parliament can deliver the need and interest of local communities to the parliament and government quickly. However, the role of The Member of Parliament varies upon personal characteristics and their bargaining power in the parliament. If The Member of Parliament get involved closely with the communities and have high bargaining power, they can be very influential for the initiatives. The role of The Member of Parliament as a stakeholder on poverty reduction and the usage of trade facilitation measures for such cause can be summarized as follows.

Interest: In principle, the Member of Parliament should have high interest on the goal of poverty reduction and the improvement of communities’ well-being as they try to maximize votes. However, in practice, the interest varies upon personal attitudes.

Importance: The priority that the Member of Parliament put on poverty reduction and the involvement of the poor in the utilization of trade facilitation measures is varied. Some of the Member of Parliament with the strong view of communities’ development give high priority on this goal and brings about many important projects on such cause. NakhonPhanom province is the good example of the strong political side which results in the implementation of several trade facilitation and infrastructure initiatives such as the Third Thai-Lao Friendship bridge, the NakhonPhanom provincial airport, a distribution center and a product exhibition center, NakhonPhanom University, and the promotion of NakhonPhanom hospital and the regional center hospital.

Influence: The Member of Parliament are a short-cut between the central government and the communities. They can voice the need, concerns and problems of local communities directly to the parliament. As a result, if they are influential the success of poverty reduction and the promotion of communities’ welfare. The example that the Member of Parliament pushes the process of compensation and relocation for the villagers in Baan Hom whose land is expropriated shows the influence of the stakeholder.

8.3 Microfinance institutions

There are two types of microfinance institutions in Mukdahan and NakhonPhanom Provinces, namely formal institutions and semi-formal or informal institutions. The major formal microfinance institutions are the bank for agriculture and agricultural cooperatives (BAAC) and the government saving bank (GSB). The semi-formal or informal institutions are village funds and saving groups in the communities.

As for the formal microfinance institutions, the GSB has low interest on microfinance mission due to lack of personnel and a variety in the branches’ mission which force the GSB officers to concentrate on other aspects such as mortgage loans with better income than micro credits. The BAAC provides financing for the farmers with the propriety right of land. Therefore, truly poor farmers might not access the BAAC’s services.

The semi-formal and informal institutions have better access to the poor in local communities. However, the interview reveals that most of the saving groups in the provinces are not as strong as the ones in other regions of Thailand. Therefore, they might not have enough capitals to provide financing for their members with the purpose of business expansion or investment. They can provide only emergency or small consumption loans. On the other hand, the strong saving groups in the provinces have no interest in lending activities as their main target is to promote communities’ savings and follow the philosophy of sufficiency economy.

The stakeholder analysis for the microfinance institutions is as follows.

Interest: Both formal microfinance institutions and semi-formal/informal institutions have low interest on micro credits. Both the GSB and the BAAC are not specialized microfinance institutions and they have other missions to be completed so they cannot focus only on microfinance activities. The saving groups in the provinces concentrate on saving activities than lending. Therefore, there are only village funds as a source of fund for micro credits. However, village funds are policy-driven institutions. If the committees of village funds decide not to depend on external finances, their abilities to give credits are limited.

Importance: The formal microfinance institutions, especially the GSB, still give low priority on micro credits due to lack of personnel. Also, as they are not specialized in microfinance activities, they have many more goals to achieve. This results in their concentration on activities and transactions that give more profits. The semi-formal or informal microfinance institutions give priority on savings and financial disciplines of the poor but not on micro credits.

Influence: As lack of financing and limited financial access are one of the main obstacles for the poor and microenterprises to fully attain gains from trade facilitation measures, microfinance institutions are very influential for the goal of poverty reduction. According to the interviews, many microenterprises, especially in the service sector, see the opportunities for business expansion and investment as a result of trade facilitation initiatives. However, they cannot obtain financing from financial institutions due to lack of collaterals and guarantors. Therefore, if there is promotion of specialized microfinance institutions that can provide micro credits to the poor and microenterprises given their conditions, both agents will better gain benefits from trade facilitation measures.

8.4 The private sector

The relevant private sector agents are provincial chambers of commerce and microenterprises. Provincial chambers of commerce aim to promote trade, agricultural, industrial and investment activities in the provinces. They provide economy and business information, business assistance, and knowledge and technology transfers to their members. The strong provincial chambers of commerce such as the Mukdahan chamber of commerce can help microenterprises to improve their businesses and attain benefit from trade facilitation measures as they can advice business opportunities and market trends, assist with the process of exporting and trading, help business matching and bring microenterprises to business road shows in the neighboring countries.

Microenterprises are one of the key stakeholders aim to obtain benefits from trade facilitation measures. The realized benefits are various. Some of the microenterprises could seek the benefits from trade facilitation measures as their products or services match the need of new consumers resulting from the measures. Some of them see the opportunities but lack financing to invest or expand their businesses. Many microenterprises lack of management and marketing skills which prohibit them from taking benefits accompanied with trade facilitation measures. A few microenterprises obtain negative impact from the measures as trade facilitation destroys their business opportunities such as retails services.

Interest: Both chambers of commerce and microenterprises have high interest on trade facilitation measures as they expect that the measures can bring about prosperous business opportunities. Some of them regard trade facilitation measures as a gateway to new markets and customers.

Importance: The priorities placed by provincial chambers of commerce on using trade facilitation measures for poverty reduction are varied. In Mukdahan province, the private sector is strong and well-connected so the chamber of commerce could initiate several projects to promote the usage of trade facilitation initiatives for the benefits of microenterprises. Some example projects are the road show of local products in neighboring countries, business matching, helping microenterprises to adjust their producing according to new demands, and microenterprises’ capacity building. However, the relatively weaker private sector in NakhonPhanom makes their chamber of commerce put less priority to such objective. The NakhonPhanom chamber of commerce rather relies on the assistance of the government sector to promote microenterprises’ involvement in the usage of trade facilitation measures than initiates the projects on its own.

As for microenterprises, they place various importance on the usage of trade facilitation measures for their businesses. Some of them regard trade facilitation measures as great opportunities for business expansion and new business investment. However, some microenterprises consider that more investment to seek opportunities in the new markets or new customers is too risky for them. Meanwhile, many microenterprises see the opportunities from trade facilitation measures on the behalf of their businesses; however, they are prohibited to grab those opportunities from lack of funding.

Influence: The private sector is a very influential agent for the success of using trade facilitation measures for poverty reduction. As for a chamber of commerce, the example of Mukdahan chamber of commerce with responsible agents for SME promotion shows the influence of the chamber to help microenterprises improve their businesses. The chamber can give relevant information about new demands, market trends, the process to trade and export, financial and management knowledge and many more which help microenterprises set up and expand their businesses.

Microenterprises are the crucial jigsaws of the success of trade facilitation for poverty reduction as well. If microenterprises have enough capacity and strong will to grab the opportunities, they are more likely to improve their business status via the utilization of trade facilitations.

8.5 Local communities

Local communities are the stakeholders affected by the implementation of trade facilitation measures the most. On the positive side, they experience more job opportunities, higher values in their farm and local products, better transportation between the provinces and the neighboring countries, and more low skilled labor. In contrary, local communities might experience negative impact from trade facilitation measures ranging from land expropriation, land speculation, gambling, crimes, drugs, prostitution, strive for health care and education services, and the low increase in wage rates due to more supply of foreign workers.

Interest: Local communities pay great attention on trade facilitation initiatives since they may use the measures for their occupation opportunities. The good example is the villagers who start to sell street food and groceries after the establishment of the bridge since the project brings more visitors to the area. Also, sometimes trade facilitation measures may cause a change in their ways of life and social structure. Some of them even lose their home and plantation due to land expropriation. The problem concerning interest of local communities comes from lack of awareness on both the existence of the initiatives and how the initiatives can affect them or give them the opportunities.

Importance: If local communities feel that trade facilitation measures have huge impact on them, both positively and negatively, they put high priorities on utilization of trade facilitation measures for poverty reduction or encounter of potential negative impact. Therefore, the proximity of communities to the location that the measures are implemented matters a lot. The communities surrounding the areas that the measures are implemented will see more importance of the initiatives.

Influence: Although local communities receive the greatest impact from trade facilitation measures and should be the agents who directly utilize the measures for poverty reduction, the communities are not influential in any projects concerning the utilization of trade facilitation measures for poverty reduction. These people are recipients of ineffective one-way communication from the government, and thus lack the opportunity to express their opinions regarding policy formulation. At times, the policies are formulated without consulting them and cause negative impact on them. The distinctive example is the establishment of a distribution center and a product exhibition center nearby the Third Thai-Lao Friendship bridge causing land expropriation from the communities in that area.

As the two provinces have difference in interest, importance and influence of each stakeholder, we will formulate different stakeholder analysis. Table 6 illustrates the stakeholder analysis of the utilization of trade facilitation for poverty reduction in Mukdahan province.

Table 6: The stakeholder analysis of the utilization of trade facilitation for poverty reduction in Mukdahan province

|

Stakeholders |

INFLUENCE Power to facilitate or impedea |

IMPORTANCE Actual Priority given to stakeholder needsb |

INTEREST Actual Commitment to changec |

|

the office of community development provincials and provincial developers |

High |

High |

High |

|

Other provincial government agencies |

High |

Low |

Low |

|

The Member of Parliament |

Low |

Low |

Medium |

|

Microfinance institutions |

High |

Low |

Low |

|

The Provincial chamber of commerce |

High |

High |

High |

|

Microenterprises |

Medium |

High |

High |

|

Local communities |

Low |

High |

High |

aInfluence: The power a stakeholder has to facilitate or impede policy-reform design and implementation.

b Importance: The priority given to satisfying the needs and interests of each stakeholder.

c Interest: The perceived level of interest/eagerness (i.e., ranging from a commitment to the status quo to an openness to change).

d Impact: The degree to which the projects/initiatives will have an impact on each stakeholder.

Table 6 shows that almost all relevant stakeholders in Mukdahan province are keen for the utilization of trade facilitation measures for poverty reduction. The influence and importance of each stakeholder for such plan are summarized in Table 7.

Table 7: Influence and importance in the utilization of trade facilitation measures for poverty reduction in Mukdahan province

|

|

High influence |

Low influence |

|

High importance |

The office of community development provincials and provincial developers, the provincial chamber of commerce, microenterprises |

Local communities

|

|

Low importance |

Other provincial government agents, microfinance institutions, |

The Member of Parliament |

The interesting issue pointed out by the influence-importance matrix in Mukdahan province is that microfinance institutions are very influential for the poor and microenterprises to utilize trade facilitation measures for poverty reduction but the institutions still put low priority to assist both stakeholders in terms of financing. This problem obstructs the poor and microenterprises to fully involve in the utilization of trade facilitation measures to improve their economic status.

The stakeholder analysis of NakhonPhanom province is summarized in Table 8.

Table 8: The stakeholder analysis of the utilization of trade facilitation for poverty reduction in NakhonPhanom province

|

Stakeholders |

INFLUENCE Power to facilitate or impedea |

IMPORTANCE Actual Priority given to stakeholder needsb |

INTEREST Actual Commitment to changec |

|

The office of community development provincialsand provincial developers |

High |

High |

High |

|

Other provincial government agencies |

High |

Low |

Low |

|

The Member of Parliament |

High |

High |

High |

|

Microfinance institutions |

High |

Low |

Low |

|

The Provincial chamber of commerce |

High |

Low |

Medium |

|

Microenterprises |

Medium |

High |

High |

|

Local communities |

Low |

High |

High |

The difference between stakeholder analysis of Mukdahan and NakhonPhanom provinces come from the roles of The Member of Parliament and the provincial chambers of commerce. While Mukdahan province has strong private sector, NakhonPhanom gains benefit from solid political one.

The influence-importance matrix of each stakeholder in NakhonPhanom issummarized in Table 9.

Table 9: Influence and importance in the utilization of trade facilitation measures for poverty reduction in NakhonPhanom province

|

|

High influence |

Low influence |

|

High importance |

The office of community development provincials and provincial developers, The Member of Parliament, microenterprises |

Local communities

|

|

Low importance |

Other provincial government agents, the provincial chamber of commerce, microfinance institutions, |

- |

The problem regarding microfinance system in NakhonPhanom province is similar to Mukdahan province. However, the relatively weak private sector and the reliance on the government sector obstruct microenterprises to gain from trade facilitation measures.

The stakeholder analysis from both provinces point out several interesting issues which can be summarized as follows:

(i) There are no financial institutions, both formal and informal, that can sufficiently meet financial need of the poor and local communities to promote the utilization of trade facilitation measures for their occupation, investment and welfare.

(ii) Apart from the offices of provincial development and provincial developers, other provincial government agents do not get involved with the initiatives that promote the poor and microenterprises to use trade facilitation measures for poverty reduction. The policy formation from other government agents rarely take into account the need and interest of local communities and microenterprises.

(iii) The involvement of provincial chambers of commerce and other large and medium enterprises are important to help microenterprise involve in value chains or businesses that benefit from trade facilitation measure. Both chambers and commercial enterprises can give the guildline regarding economic and marketing knowledge, market trend, the short cut to initiate trade and export activities in neighboring countries, the way to get financing from financial institutions, the privilege rights, tax exemption, tariff privilege and other law and regulation issues.

(iv) The provinces with the strong and powerful people’s representatives can benefit from their role as a bridge between the central and provincial governments and the communities.