2010.06-Working Paper-China Africa in Agriculture A background paper on trade, investment and aid in agriculture

CHINA AFRICA IN AGRICULTURE

A background paper on trade, investment and aid in agriculture

Jean-Raphael ehaponniere, Jean Jacques Gabas, Zheng Qi

China-DAC Study Group on Agriculture, Food Security and Rural Development, Bamako, April 27-28, 2010

This paper investigates China Africa exchiangas in agriculture which is a smail component of the ChinaAfrica turaide.The second part looks at Chinese aid to agriculture and the third one analyzas Chineseinvestment in African agriculture with specialemphasis on investment in land.

l. CHINA AFRICA TRADE IN AGRICULTURE

After a brief introdUCtion to Chinese and African agriculture.this part analyzes Chinese and African trade and dlscusses tWO, issues: Is there a complementarity batween Chinese demand and African supply? What could be the consequence of the transformation of Chinese consumption on Chinase agricultural imports.

A brief introduction to Chinese and African agriculture

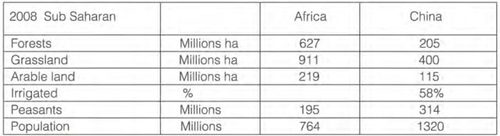

Even if China is the third largest country after Russia and Canada , its arable lartd is oniy 122 million ha (Table l).Thust China's agriculture feeds 20% of world populatiorn with 8% of world arrable lands(Brautingam, 2009).

Table1

Source:FAO,CBS

The 1978 reforms shifted the responsibility for farming to households without gcving them the ownership of the land: they number 200 million with an averagEa land area of only 0.6 ha. Prior investments in rural infrastructure and a high level of literacy explain the success of the reforms (Ravaillon 2008)2. Price and market liberalization started in the 1990s when food became plentiful. However, as stressed by Aubert (2007), while Chinese agriculture is highly productive when one measures its yields per hectare, Chinese peasants are poor as their agricultural labour productivity is one sixth of non agricultural labor productivity. This contributas to the urban-rural divide. Fighting against inequality has been the objective of the govemment since 2003.

Agricultura was able to satisfy the rising food demand. Per capita food availability and nutrition improved for a vast majoriW of the population. In 2005, per capita food availability reached 3.040kcal per day, a level that is 14% higher than the average of developing countries and 8% higher than the world average.

African agriculture area is suited, in parts at least, to the production of a broad range of agricultu ral commodities.

Only 16% is used for arabIe craps (Table l) and a minute l% is undar irrigation. One should avoid sweaeping statements on African agriculture as there are 53 countries. Nevertheless, among the common constraints which impede its developmenti there has

been a lack of political commitment and the perception that smallholder agriculture is unable to contribute to economic transformation. In sharp contrast to China,international donors have been influential actors in agricultural policy as ODA financed a large share of investment in this sector.

While Chinese agriculture is a commercial activity, it is not the case in Africa and it is estimated that around 25% of cereals (sorgho, mil) production go to the market.Based on a survey of several African countries a World Bank study (2009) concluded that Afrrcan producers are generally compaLitive on domestic markets and competitive in global market. Their competitiveness at the farm level derives largely from very low returns to labour (reflecting the absence of altemative employment opportunities in rural areas) and limited use of purchased inputs. Furthermore, high logistics costs raise the prices of imported commodities and providea certain degree of "natural protection". These high logistics costs represent an obstacle for exportts as they must be absorbad by Afncan axporters in order to be competitive on world markets.

Chinese and African agriculture in the world, market

In the 1980s agriculture accounted for one quarter of Chinese exports and its share is now 30% (2008) and 5% in the case of imports. One of the striking features of Chinese agriculture is its small trade openness as imports account for only 6% of apparent consumption(dafined as production plus imports minus exports) and 5% of production is ecported.

Chinese entry to the WTO led to a spectacular increase of soja, oilseecls, cotton, and wool imports but China remained a net axporter of careals. While Chinese agricultural imports are highly concentrated, its exports are diversified. China's main trading partners for agro prroducts are Asia and ALENA for exports, Asia and South America for imports; Africa plays a very minor role neither as an exporter nor importer.

Accordmg to Cepii data base (Chelem), Africa's share of agricultural world trade is clase to China's (6%).However, this average is not significant for countries such as Malawi (85%), Burkina (83%), Uganda {62%), Ethiopia (61%), Mali (56%), Kenya (46%), Rwanda (44%), Ghana (42%), Senegal (37%), Tanzania (35%),Madagascar(31%),Togo (29%) Swaziland (21%), and Niger (14%), African imports doubled between 2000and 2007.Exports are concentrated in a few products and have increased at a slow pace.

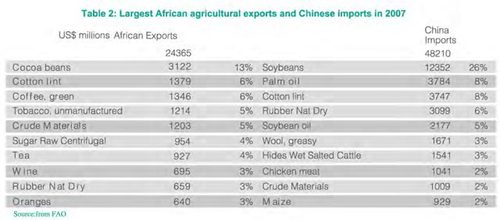

A cursory look of FAO trade statistics (Table 2) reveals a limited overlap between African exports and Chinese imports as two items appear in the top ten Chinese imports.

Box1: Agro trade complementarity

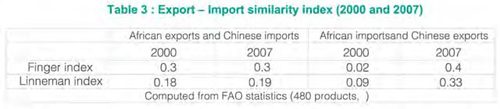

To go beyond this first assessment, two indicatars currently used to measure export similarities have been adapted to measure the complementarity between African exports (imports) and Chinese imports (exports). They have been computed for 2000 and 2007 0n the basis of FAO trade data(480 items).

Table 3 shows that the structure of African agricultural Bxports is quite dissimiiar to that of Chinese imports and both indicators conclude that the degree of dissimilarity has been constant between 2000 and 2007, These indicators show that Chinese agricultural exports structure has become more similar to the structure of African agricultural imports from the world.

China Africa trade in agriculture

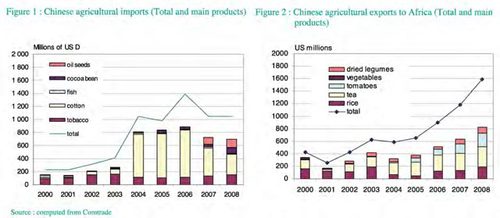

Agriculture is a small component of China-Africa trade, which increased tenfold between 2000 and 2008. Aftar a rapid increase between 2000 and 2004, Chinese agro products imports from Africa stagnated while Chinese exports have kept increasing together with Chinese trade surplus with Africa.

Conducted at a 4 digit fevel, the analysis of China Africa trade reveals a strong asymmetry. A Chinese import from Africa (Figure l) is concentrated and the share of the largest 5 products has not changed from 2000 to 2008.The diminishing value of cotton exports explains the stagnation of African exports to China. During the last two years, cocoa and oil seeds imports gained in importance. While African exports dominate the Chinese market for cocoa (66% of imports), their share diminished in the case of cotton (see infra).

Rice and tea are traditional Chinese agricultural exports to Africa (Figure 2) which have diversified from 2000 to 2008 as new praducts appeared (tomatoes, vegetablesetc.). While the African market accounts for a very small part of Chinese exports, it is nevertheless significant for rice (West Africa) and tea (North Africa and West Africa) and Africa absorbed respeactively 40% and 46% of Chinese exports in 2008. African agricultural exports have not benefited from the fast increase of Chinese imports as its export structure is different from Chinese import structure. On the other hand, Chinese food exports which are competitive on the world market(Rozelle, 2007) are making inroads on the African market.

Box 2: China Africa wood and wood, products exchanges

China is the worlds largest exporter of wood products and its industry relies extensively on wood imports from Russia,South East Asia and Africa. African wood is increasingly exported to China by Gabon,Cameroun, Equatorial Guinea.Congo and Mozambique. While many African countries export sawn logs toport sawn logs to UE they export "wood in the rough(HS4403) to China. A significant part of these exports are 'illegal' and the EU"Forest Law Enforcement on Governance and Tradee" has not yet included Chinese wood products imports from China. While the share of Africa in Chinese wood imports has slightly dlminished since 2000 to 20%, Chinese wood products exports to Africa increased rapidly.

Perspective

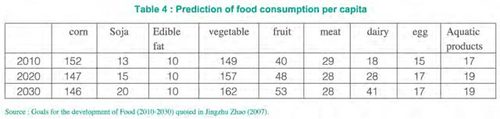

Chinese agriculture is facing severe constraints (land,watear, manpower) while urbanization, demography will modify the behaviour of the consumer. According to the United Nations scenarios (low, medium and high), the Chinese population could increase between 75 and 230 million from 2010 to 2030. Urbanization could increase very rapidly as measures that regulate rural exodus may

be lifted. Population pressure, urbanisation and income increase will modify Chinese demand. The most noticeable change of the last ten years has been the shift in consumption from cereals to meat, fruits, vegetables and milk products. According to Chinesa projections (2030), per capita consumption of cereals will diminish by 1O% and there will be a substantial increase in dairy products and vegetables consumption and, surprisingly no increase in meat consumption. Alternative world scenarios(Agrimonde 2008) fo resee a radical shift in

meat consumptian and a rapid increase in meat consumption With the increase in income. These alternative scenarios lead to different conclusions for Chinese imports (see Box 3).PopulaOon and urbanization could reduce arable land availabilityr to 120 million hactares. According to IIASA and FAO, land availability is less a concem than water availabilityT even if there are possibilities to achiave a better utlization of this resourca.Moreover since the mid 19aOs, the Chinese government has engaged research in bio technologies in order to maintain the food security and China ranks nowadays among the warld leader in this rield. According to IIASA and FAO, China land and water resources are sufficient to face the needs of a population of l,48 billion as it could produce a sufficient amount of cereals to satisfy the demand in all scenarios, while keeping a quarter of the arable area for fruits and vegetables. Nevertheless,economically wise, China may choose to import a percentage of its cereals needs. Thus according to Zhao (2008) China's food self-sufficiency ratio could be about 95% in 2030 and this will leave an annual gap of 30-35 Mt "Even with increased agricultural science and technology input and policy input. it is still a severe challenge to ensure the current produc;lion level of 500 million tons; Guangdong, Zhejiang provinces have beacome the major rice import provinces".

Box 3: alternative scenario

Agrimonde (2009) has elaborated twa long term (2050) world scenarios. Concerning Asia, it foresees a more pronounced shift towards meat which will increase the demand for cereals and oil seeds while arable area will diminish. Thus according to Agrimonde, China may become an important importer of cereals and oilseeds. In Africa,arable land potential is huge, five times the arable land of 200 millions ha but if one takes into account yield evolution and population increase, Africa could stay a food importer. Asia and Africa will rely on exports frrom Latin America,CEI and OECD to meet its food import demand.

Conclusions

In 1995 Lester Brown published a book"Who Will Feed China? A Wake-Up Call for a Small Pianet' where he concluded that China would turn to internationai grain markets to meet the demand of its increasingly affluent population. Since the publication of this book , Chinese agriculture was not only able to meet the basic food needs but it stayed a net cereal exporter and stepped up it food exports.

As both production and consumption of cereals will diminish, China may stay a net cereal importer (however it could become a corn importer even if yields increase may limit importations). In the case of soja, imports represent of domestic demand. As most projections assuma that these imports will increase, Bryan Lohmar,(2009) suggests that the introduction of OGM could reduce imports. China will stay a large importer of vegetable oil and sugar. Chinese production of fruits and vegetables will increase as the demand for these products will be strong. Nevertheless according to Rozelle (2007): this sector competitiveness may be limited by the availability and cost of water, land, and labor and in the long-run, China may not remain competitive in the production of many agricultural commodities.“Until that time, however, there will be a race between China's ability to supply what consumers want and the incraasing pace of domestic demand. If the supply side wins, China's producers will enjoy the fruits of both supplying the large domestic market and exporting. If the demand side pulls ahead, there will be opportunities for international horticultural producers to sell to China's market".

Thus, even if the jury is still out to assess if China will be able or not to feed China, China's most dynamic imports may not be those products that are axported by Africa.While this conclusion does not open opportunities for Africa, the trend in Chinese exports to Africa suggest that there are import substituting opportunities in Africa for agricultural products.

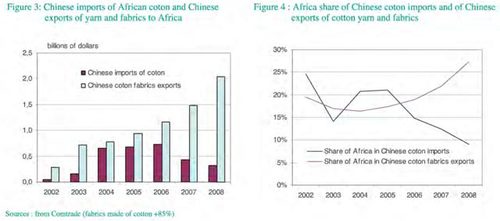

China is the world's largest producer and importer of cotton. Africa is a modest producer that exports a large part of, its production as tt has not been able to develop a competitive textile industry. According to ICAC, Chinase cotton imports increased rapidly between 2003 and 2006 and have diminished both in value and in volume. During the same period African cotton exporls decreased from 1 million tons t0 0.5 million tons. According to Comtrade China is the largest market for African cotton and these imports are transformed into yarn and fabrics. A significant part of Chinese exports of both yarn and fabrics go to Aihrica where they are used by the garment industry and by the informal sector. Thus while the share of African cotton diminished from 25% in 2005 to 9% in 2008 of China imports, the share of African market in Chinese exports of cotton yarn and cotton fabrics rose to 26% in 2008 (Figure 4).

If one takes a comprehensive view of lextile trade between China and Africa (Figure 3). from cotton production to weaving, African deficit has considerably increased as in 2008. Africa exported 180 000 tons of cotton to China (300 million dollars) and imported 118000 tons of cotton yam and fabrics (2 billion dollars).

This deficit would be more important if one took into consideration Chinese exports of garments (made with cotton). The rapid increase of Chinase exports of textile products to Africa leads to concluda that there exists a potential of import substituting activities by Chinese in Africa.

II. CHINA'S AID TO AFRICA IN AGRICULTURE : CONTINUITY AND EVOLUTION

China started agricultural assistance to Africa by offering free food aid, a kind of development assistance, to the Government of Guinea in 1959. Since then, Sino-Africa agricultural cooperation has gone through three stages during nearly half a century, featuring continuity and evolution, shifting from "provided as requfred and project as carrier" to "institutional and sustainable norm" (COHD and CLAD, 2010).

In 1960s and 1970s, China helped build a large number of farms in Africa, such as Tanzania’s Mbarali farm and Tuvu farm, Somalia's Fano Farm, Uganda's Chipemba farm. Guine's Koba sugar cane farm, Mali's two sugar cane farm Mauritania's Beam Mpoli rice farm, Sierra Leone's sugar cane farm, Niger's 4 reclamation areas, Togo’s sugar cane plantations, Republic Democratic of Congo sugar cane farm, etc., raaching 87 projects in total, and covering 43.400 hectares.These farm assistances were managed by Chinese experts and financial assistance. However, this kind of aid was considered not sustainable and confronted difficulties when these farms were transferred to the recipient governments (COHD and ClAD, 2010).

From the mid-19aOs onwards, more of these bilateral agricultural projects became joint ventures looking for profit under the "going out" strategies. The Chinese govemment encouraged and allowed some enterprises especially state-owned enterprises to join in foreign aid work. China's State Farm Group and provincial State Farm Groups began restructuring farms in Africa. Thus the farm model changed from pure State owned to government supported enterprise. Within this new paradigm, Sino-Zambia Friendship Farm, Xiyangyang

Farm and Sunshine Farm China State Farm Group Jiangsu Cultivation Co. have been established in Zambia. These farms are managed by Chinese personnel who hire local farmers as workers to produca agricultural products for the local market (COHD and ClAD, 2010).

The third period started in 2000, with the creation of Sino-African Cooperatian Forum. China is actively applying the South-South cooperation mechanism and other multilateral mechanisms to extend agricultural assistance to Africa. By the end of 2005, 145 agriculture aid projects have been established in the form of constructing farms, testing stations, and technology demonstration centres,and sending agricultural experts. Until the end of 2008, Chinese companies had invfasted In Africa for the establishment of 72 agriculture enterprises. with a direct investment of 134 million US dollars coming fram the Chinese side.

box 4 : Agricultural Technology Expert Dispatching

China sent agricuttural experts to Africa as early as the 1960s. They were mainly appointed according to Africa's invitation and request, such as in Mali and Uganda. This experts dispatching is considered as an important way of assisting African agricultural deVelopment and is applied in bilattaral and multilateral mschanisms. Since its participation in South-South cooperation in 2006, China has sent a total of 15 batches of technical personnel (496 people in total ), distributed in 36 states,up until 2007. In the bilateral cooperation mechanism, since the China-Africa Coaperation Forum in 2006, China has dispatched nearly 100 agricultural experts to more than 30 countries in Africa so far. They generally join in or assist African countries' agricultural sectors and relevant agencies. (COHD and CIAD,2010)

In China's African Policy related to agricultural cooperation, the focus is on cooperation in land development, agricultural plantation, breeding technologies, food security, agrjcultural machinery and the processing of agricultural and side-line products. It also involves carrying out experimental and demonstrativa agricultural technology projects in Africa. In addition,cancerning resources cooperation, China encourages and supports competent Chinese entarprises to cooperate with African nations in various ways on the basis of the principle of mutual benefit and common development, to develop and exploit rationally their resources.

B0x 5: Experiment station and agricultural technology demonstration centre

Since the 1950s, China has helped to establish some technology expenmental extension stations as a major part of China's assistance to develop agriculture in Africa by transferring agricultural technologies. For instance,13 rice technology promotion stations were estaslished in Sierra Leone in 1971. However, due to the weak sustainability of these previous experiment stations, the new constructions induce China's agricultural enterprises to take part. They are initiated by virtue of government aid, and managed by aid companies once the aid money ceases. After the China-Afnca Forum Summit in 2006, the Chinese govemment planned 20 projects in Africa, of which 14 are alrraady under construction. The Hosting countries are: Egypt, Sudan,Ethiopia, Uganda, Rwanda, Tanzania, Zambia, Mozambique, Zimbabwe. South Africa, Togo, Benin, Cameroon and Democratic Republic of the Congo (Deborah Brautigam, 2010).

China also created new tools to raalise tha goai of mixing bilateral development aid with other forms of economic engagement. China's Export Import Bank uses concessional loan and preferential buyer's credits in order to finance Chinesa companies investing overseas. Agro-industrial crops.animal husbandry and aquaculture, as well as agricultural machinery are classified as the preferred projects by the Chinese government. In 2007, the China-Africa Development Fund was astablished aiming to support Chinese inVeStments in Africa. In 2009.this fund started its largest agricultural project in Malawi in cooperation with two Chinese companies. This project aimed to invest 25 million dollars in cotton plantation, process and export to China. It is reported that almost 50 000 smallholders have benefrtad from this project.

III. CHINESE INVESTMENT IN AGRICULTURE: THE CASE OF INVESTMENT IN LAND

Since the food crisis of 2007, a lot of attention has been given to "land grabbing" in Africa and China has been labelled as a land grabber pursuing a food security strategy.

Although the actual facts have yet to be investigated,information gathered from intemational organizations and NGOs offer a picture of what is going on. GRAIN, a Spanish-based NGO, has monitored media articles that reparted around 180 land deals at varying stages of negotiation. International Food Policy Research Institute (IFPRI) documented reports on 57 land deals. lIED,FAO and IFAD compited a large database on this lssue.The International Institute for Sustainable Development has analyzed the water component of foreign landpurchase (Cotula and Vermeulen, 2009; Mann and Smaller, 2010).

Land acquisition, new phenomenon or old topic?

Land acquisition is hardly a new phenomenan as it happened during colonial times. Afteir independence.African as well as Latin American gavernments have sometimes agreed to the appropriation of land by trans-national corporations (rubber, oil palm, banana,pineapple) without putting place any regulatory mechanisms, and this created hardships for local communities that previously used these areas. The land acquisitions which appeared in the 2000s differ from the previous instances as they often target food security and scale.

Among the countnes looking for land there are capital rich food-importing countries with limited land and water resources (Gulf States, Libya) : large countries where food security may become an issue {China, South Korea,Japan,and India) ; OECD countries and Brazil looking for iarge tracts of land in order to praducra agro-fuels. Morerover, countries such as China, India and Egypt are both investors and hosts of investments.

Between 2006 and the middle of 2009, the IFPRI found that foreign investors saught or secured between 15 million and 20 millian ha of farmland in the developing world (Cotula et al, 2009). In the case of five African countries (Ethiopia, Ghana,Madagascar, Mali and Sudan) there has been a total of about 2.5 million ha approved land acquisitions since 2004, a total that excludes acquisitions of surfaces below 1000 ha. This phenomenon is anticipated to grow in the future.

lrrigated lands as well as water appear to be a significant driver for these investments. Investors are targeting Sudan and Mozambique and even countries faced with critical water shortage such as Mali.

Analysis of Chinese engagement in African Agriculture

According to Chinese government officials.by and large,Chinese investment in African agriculture iS geared at addressing food shortage in Africa as well as raising African capacity for self-development in agrlculture.Chinese investment in African agriculture can be dated back to 1990s. The govemment does not ctiredly interfere in the fnvestment decision of the state owned enterprises but offers support and incentives in the form of finance and diplomatic support. China encourages Chinesa companies to invest in the farming sector in Africa through a variety of forms, including joint venturest joint stock companies or solely-owned companies. Chinese investment in agriculture can be divided to three categories;

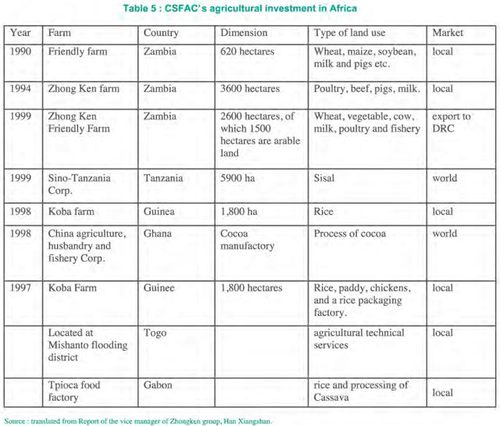

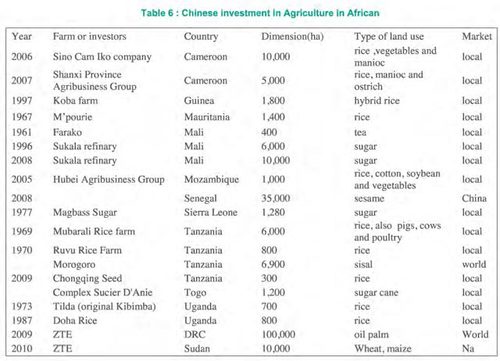

-State owned enterprises play a major role and often get Central Government support. The most signiicant is China State Farms Agribusiness Corporation (CSFAC, originally Nongken Farm Corp.) considered as a successful model.Since 1990, it established11 agricultural and husbandry production and processing projects in Zambia, Guinea.Tanzanla, Gabon, Ghana, Mali,Togo,Mauritania and other African countries occupying around l6 000 hectares.Another state owned enterprises is China's ZTE Agribusiness Company Ltd which plans to establish a 100,000 hectares oil palm plantation in the Democratic Republic of Congo (DR Congo) for bio fuel production. (D.Brautigam, 2008)

-Provinciat actors such as Shanxi Province Agribusiness Group which acquired a 90 year lease of 5000 hectares land in Cameroon and has invested 62.5 million dollars for rice,manioc and ostrich raising. Hubei Agribusiness Group rented 1000 hectares land in Mozambique cooperating with China Cereal & Oil Corporation for rice,cotton.soybean and vegetables. Whila CSFAC activities and its provincial arms are often closely associated and are often regarded as aid rather than commercial investment, other regional companies are more activaly seeking business opportunities.Chongqing Seed which has a 300 hactares rice plantaton in Tanzania is a perfect example.

-Finally at the grassroots level there are a large number of individual initiatives.Information of these activities is difficult to gather however their impact should not be ignored.

Thus, the nature of China's inveStment activities in Africa is multi faceted. Some are managed by the Central Government thraugh the transfer of technical assistance.A significant number are carried out by provincial level enterprises but with the support of the China Africa Developmant Fund or with incentives from host cauntries as is the casa of Zimbabwe and Zambia.

Issues raised

Chinese investment in African agriculture brings capital and technology. According to a report, the introduction of water-saving technologies and soil-related techniques such as tillage and planting methods are particularly beneficial. However it could be argued that these examples refer to farms established in an earlier phase of China's engagement.

New investment raised new concerns. Thus, among the 34 large scale projects recorded by IFPRI in Africa from 2006 to 2009, Chinese investors ara involved in only 4 which are questionable. One of them is in Mozambique where the initial intention may have been to settle a large number of Chinese to manage mega-farms and cattla ranches. According to Loro Horta and Stephen Marks, a memorandum of understanding (MoU) was reportedly signed in June 2007, under which an initial 3,000 Chinesa settlers were to move to Zambezia and Tete Provinces to develop farms along the valley,considered as one of the more fertile areas. Reports of this deal caused an uproar and the Mozambique government was forced to dismiss the whole story as false. It is reported that the government plans a joint venture with Mozambican participation. The second

Project is being discussed in Zambia; this 2 million hectares farm for bio fuel raises many critics. The third one is an oil palm plantation in DRC. The media reported a 2.8 million ha deal while the actual area is 100,000 hectares (Brautigam,2009). The fourth also in negotiation is 10,000 hectares is confronted to local opposition.

These setbacks may be a sign for China, as Loro Horta concludes, China would be better advised to listen to and negotiate with the people actually living there. lf fine-turned, China's agricultural plan could bring tremendous benefits for both sides.

Nevertheless while it is acknowledged that Chinese large-scale investments in agriculture aimed at food security and commercial interests are under way in the Philippines. Brazil, Laos and Burma, no one can be sure that this would not happen in Africa.

Stephen Marks believes that it should be in the interests of Africa's farmers as well as campaigners concerned with issues of food sovereignty and sustainability. to make common cause with China's more far-sighted policymakers. The aim must be to ensure that China's agricultural involvement in Africa takes place within a policy framework that maximizes a long-term 'win-win' approach including technology transfer, infrastructure investment, and increased food scanty and sustainability for both parties.

This survey at large-scale land appropriation in Africa shows that these interventions are not new but do seem to be intensifying in recent years. It is difficult to appreciate their size and their agricultural practice (lab our intensive or not, ecologically intensive or not, etc.).Available information indicates that Chinese investments are aimed at local or regional markets and not to the Chinese markets. The exception could be investments in biofuels which may be export oriented and target the European market.

CONCLUSION:

The analysis of China's investment in African agriculture shows that Chinese farms in Africa can be dated back to the 1960s. OECD countries' aid to agriculture which had been significant in the eighties, diminished in the nineties. In the late 2000s.traditional donors as well foundations have taken new initiatives for agriculture.

In the case of China, private enterprises and individuals have increased their involvement in African agriculture. Chinese investments in African land appear relatively less alarming as compared to other foreign acquisitions and, by and large. Chinese investments are targeted to local food consumption. For many stakeholders and observers, China's involvement might bring opportunities to African states and local farmers. Nevertheless one should pay attention to possible challenges and problems because it is perhaps on agricultural where China may have a significant impact on the continent's future. Whether China's involvement in Africa will really help the continent in alleviating its chronic food shortages and poverty, or whether it will became another of the many empty promises made to Africa remains to be Sean.

扫描下载手机客户端

地址:北京朝阳区太阳宫北街1号 邮编100028 电话:+86-10-84419655 传真:+86-10-84419658(电子地图)

版权所有©中国国际扶贫中心 未经许可不得复制 京ICP备2020039194号-2